Compound investment return calculator

For any typical financial investment there are four crucial elements that make up the investment. On the surface it appears as a.

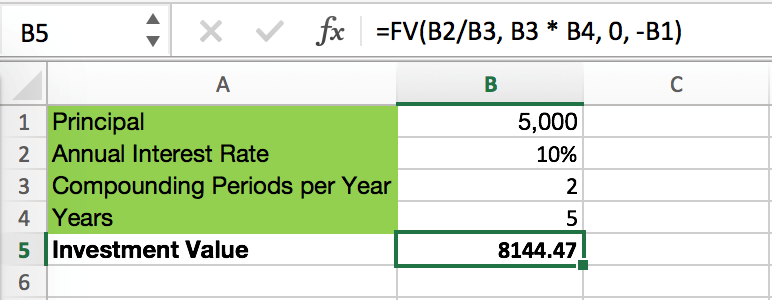

Compound Interest Formula In Excel And Google Sheets Automate Excel

But if you are able to invest that amount regularly for 35 years you could wind up with roughly 900000 more than doubling your return even though youre only investing 60000 more.

. Use Forbes Advisors return on investment calculator to help plan your long-term in. Daily compound interest is calculated using a simplified version of the formula for compound interest. If you invest 500 per month for 25 years for example you could wind up with about 400000.

You can also sometimes estimate the return rate with The Rule of 72. Return rate For many investors this is what matters most. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

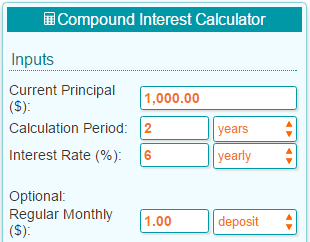

Bobs ROI on his sheep farming operation is 40. Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. How to Use the Compound Interest Calculator.

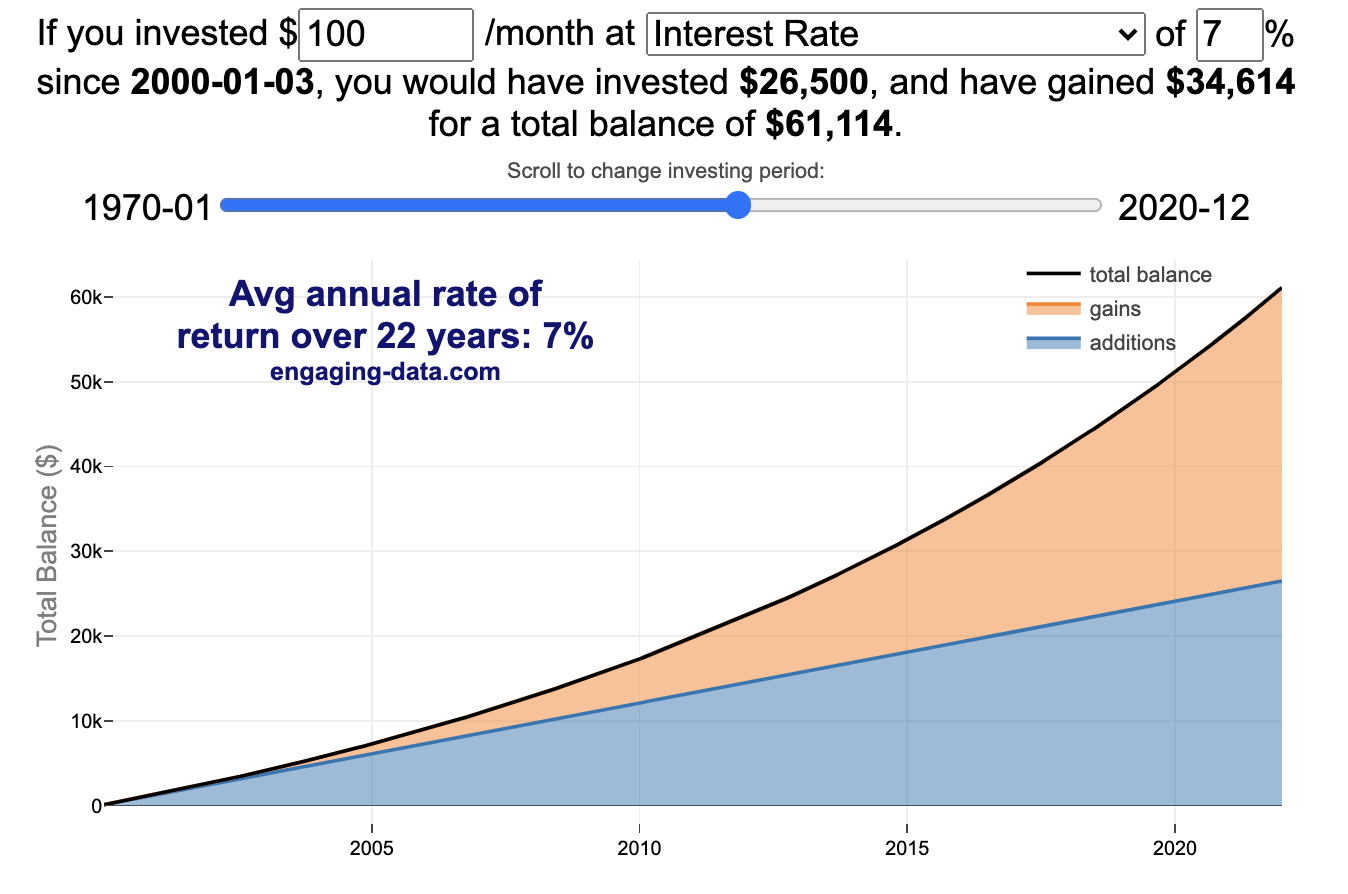

See the CAGR of the SP 500 this investment return calculator CAGR Explained and How Finance Works for the rate of return formula. Investment returns calculator There are several factors that can contribute to meeting your long-term investment goals. CAGR Calculator is free online tool to calculate compound annual growth rate for your investment over a time period.

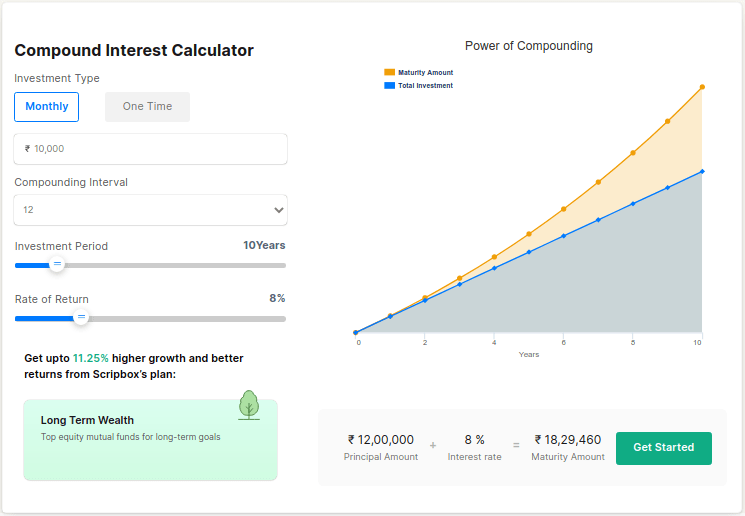

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Compound interest is the engine that powers your investment returns over time. However when you have debt compound interest can work.

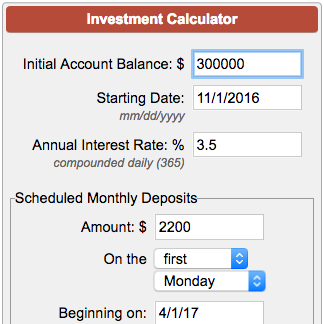

Expand your knowledge about investment opportunities in crypto assets on our spotlight page. How to calculate daily compound interest. A Compound Interest calculator is used to calculate the projection for compound growth for your savings account or investment for different periods of time based upon a certain rate of interest.

Taking Stock in Teen Trading. Optionally choose to compute compound annual growth rate. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

We start with A which is your investment horizon or goal. It is the basis of everything from a personal savings plan to the long term growth of the stock market. This calculator shows the return rate CAGR of an investment.

A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. To begin your calculation take your daily interest. The default value 20 equals the rate currently paid on five-year Guaranteed Investment Certificates1 You may change this to any rate you wish.

Compound Interest Explanation. Our Directors Take article can help parents and teens learn how to start making sound financial decisions together. CAGR makes it possible to compare profits from a particular investment with risk-free instruments.

CAGR is one of the most accurate ways to calculate the return on an investment that rises and falls in value during the investment period. To compute compound interest we need to follow the below steps. So compounding is Interest on interest.

To get the CAGR value for your investment enter the starting value or initial investment amount along with the expected ending value and the number of months or years for which you want to calulate the CAGR. Enter the details of a stock purchase and sale including the number of shares commissions and buy and sell price to see your net stock investment return and return percentage. P the principal amount the initial amount invested r the annual interest rate.

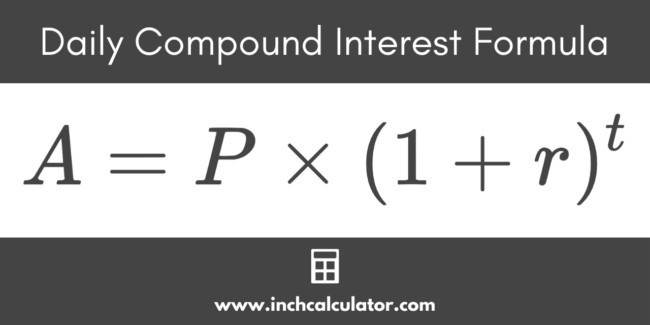

The annual rate of return for this investment or savings account. Daily Compound Interest Formula Calculator. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account.

V the value of investment at the end of the time period. If Bob wanted an ROI of 40 and knew his initial cost of investment was 50000 70000 is the gain he must make from the initial investment to realize his desired ROI. Compounding is the effect where an investment earns interest not only on the principal component but also gives interest on interest.

Compound Annual Growth Rate - CAGR. Say you have an investment account that increased from 30000 to 33000 over 30 months. CAGR allows investors to compare investments with different time horizons.

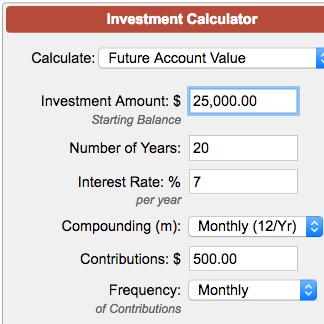

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade. It also allows you to assess.

In other words the results of what you can achieve through the magic of. Daily Compound Interest Formula. Its never too early to start thinking about saving and investing.

Use this calculator to gain a better understanding of how different inputs can impact the rate of return on your investments then connect with an Ameriprise advisor who can provide personalized advice for your long-term goals. Enter the annual compound interest rate you expect to earn on the investment. Find out the initial principal amount that is required to be invested.

A mathematical formula for calculating compound interest as used by this online calculator can be stated as. V P 1 r n n t. The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year.

Even small deposits to a. The actual rate of return is largely dependent on the types of investments you select. This means that your wealth grows by earning investment returns on your initial balance and then reinvesting the returns.

The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return. The Standard Poors 500 SP 500 for the 10 years ending December 31 st 2021 had an annual compounded rate of return of 136 including reinvestment of dividends. Our compound interest calculator below will help you see how money.

On this page is a stock calculator or stock investment return calculator. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Return on investment ROI is a metric used to understand the profitability of an investment.

Conversely the formula can be used to compute either gain from or cost of investment given a desired ROI. With links to articles for more information. CD Calculator Compound Interest Calculator Savings Calculator Budget Calculator.

Compound Interest And Stock Returns Calculator Engaging Data

Daily Compound Interest Calculator Inch Calculator

Daily Compound Interest Formula Calculator Excel Template

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

Investment Account Calculator

Compound Interest Calculator Inch Calculator

Compound Interest Investor Gov

Compounding Interest Calculator Yearly Monthly Daily

Compound Interest Calculator For Excel

Walletburst Compound Interest Calculator With Monthly Contributions

Power Of Compounding Investment Calculator Scripbox

Compound Interest Definition Formula How It S Calculated

Investment Calculator

Compound Interest Calculator Daily Monthly Yearly

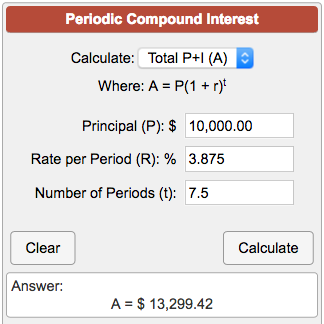

Periodic Compound Interest Calculator

Compound Interest Calculator With Formula

Compound Interest Formula With Calculator